will child tax credit monthly payments continue in 2022

The law authorizing last years monthly payments clearly states that no payments can be made after December 31 2021. However Congress had to vote to extend the payments past 2021.

How Does Child Tax Credit Work For Divorced Parents And Other Non Traditional Families The Washington Post

I have written detailed articles covering FAQs for this payment but the main one being asked now is whether or not families will continue to get paid monthly in 2022 starting with the first payment on January 15 2022.

. Parents can still receive Child Tax Credit payments when they file their 2021 tax return Credit. Last year the child tax credit got a number of key enhancements. Government disbursed more than 15 billion of monthly child tax credit payments in July to American families.

Therefore child tax credit payments will NOT continue in 2022. Therefore child tax credit payments will not continue in 2022. Thats because only half the money came via the monthly installments.

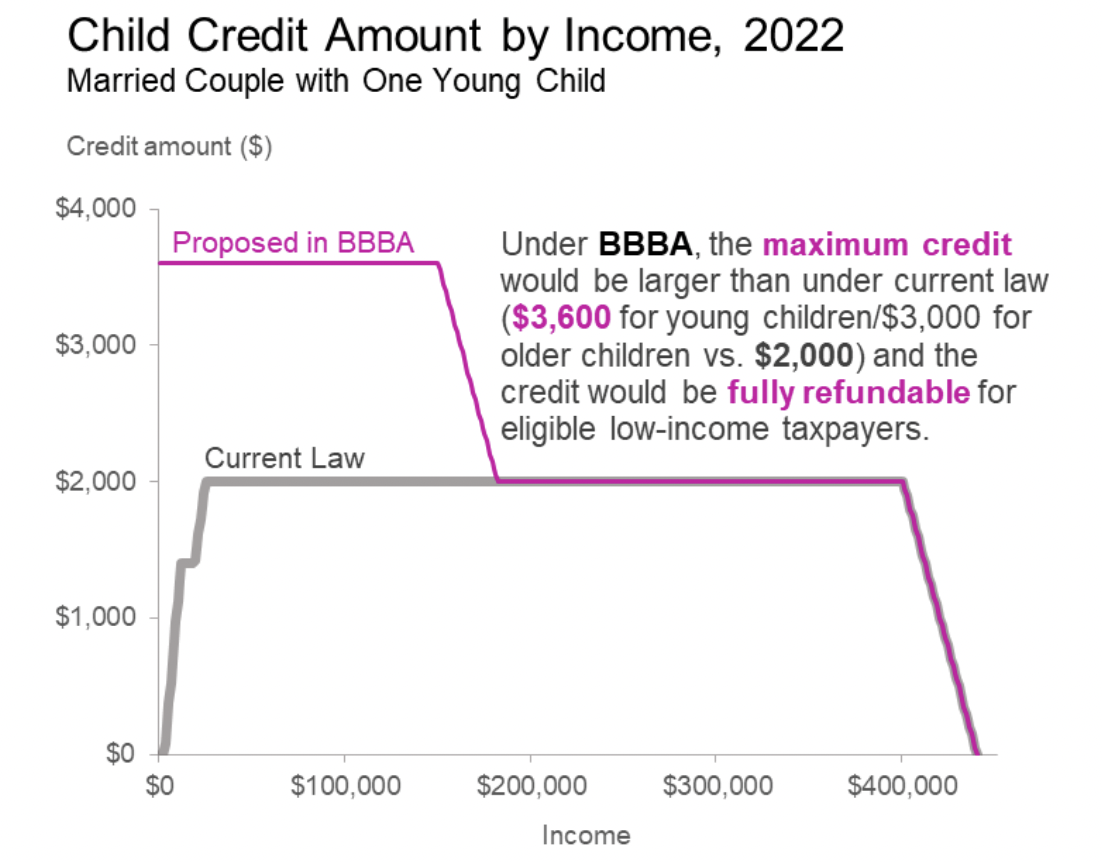

He had hoped to continue that in 2022 but without the passing of the Build Back Better bill the credit returned to 2000. Child care tax credit payment dates 2022ccb young child supplement payment dates. Here is what you need to know about the future of the child tax credit in 2022.

Advanced monthly payments totaled 300 per child under the age of 6 and 250 per child ages 6 to 17. No Child Tax Credit Means Risk of Falling Back Into Poverty. The future of the monthly child tax credit is not certain in 2022.

President Biden wants to continue the child tax credit payments in 2022. Washington lawmakers may still revisit expanding the child tax credit. But this may not preclude these payments.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Get updates on Advanced Child Tax Credit at 2021 Child Tax Credit and Advance Child Tax Credit Payments Frequently Asked Questions. The benefit for the 2021 year.

Child Tax Credits May Be Extended Into 2022 As Payments Worth Up To 900 Could Be Sent Out. Recipients will have to meet certain criteria to pocket the maximum amount. American parents have likely received their.

The child tax credit payments were part of President Joe Bidens American Rescue Plan signed into law in March 2021. Most payments are being made by direct deposit. It changed the structure to a monthly stipend instead of an annual lump sum.

Child tax credit payments will continue to go out in 2022. In addition to reviving the tax credit payments for 2022 bidens stalled build back better bill would boost funding for the. The short answer is NO since a funding extension for 2022 payments has not yet been approved by Congress.

And while the final monthly payment of 2021 went out Dec. A more modest child tax credit remains in place for the 2022 tax year and beneficiaries can still claim half of the 2021 expansion that wasnt sent out in the monthly. Congress fails to renew the advance Child Tax Credit payments which would have been part of the Build Back Better Act and the payments expire.

However some are still not aware of that. Therefore child tax credit payments will NOT continue in 2022. Losing it could be dire for millions of children living at or below the poverty line.

Therefore child tax credit payments will not continue in 2022. The bill did not pass and advanced monthly Child Tax Credit payments will not continue in 2022 though parents can still claim a portion of the 2021 expanded credit on their tax returns this season. In 2021 President Biden expanded the child tax credit from 2000 to 3600 and let families collect monthly payments in advance.

As tax day nears many parents could get the remaining sums of the more generous child tax credit for 2021. Most parents who received monthly payments in 2021 will have more child tax credit money coming this year. 15 Democratic leaders in Congress are working to extend the benefit into 2022.

That 2000 child tax credit is also due to expire after 2025. Now even before those monthly child tax credit advances run out the final two payments come on Nov. 1 day agoThe child tax credit was a lifeline.

Families are still reeling from the pandemics impact even as a new variant is emerging so its crucial that these payments continue into 2022 she continued. However for 2022 the credit has reverted back to 2000 per child with no monthly payments. For the period of july 2021 to june 2022 you could get up to 2915 24291 per month for each child who is eligible for the disability tax credit.

This program only applies to two children for a total of 7200. Heres what you need to know about the child tax credit as the calendar turns from 2021 to 2022 including what it will look like in the new year how it. The deadline to file your 2021 tax return is Monday April 18 2022.

This final batch of advance monthly payments for 2021 totaling about 16 billion was sent to more than 36million families across the country. If you opted out of the advanced child tax credit CTC payments you will receive the full child tax credit of. Those who opted out of all the monthly payments can expect a 3000 or 3600.

No monthly CTC.

Thousands Of Low Income Families To Get 1 800 Per Child Tax Credits Next Month

Child Tax Credit 2022 Where We Stand

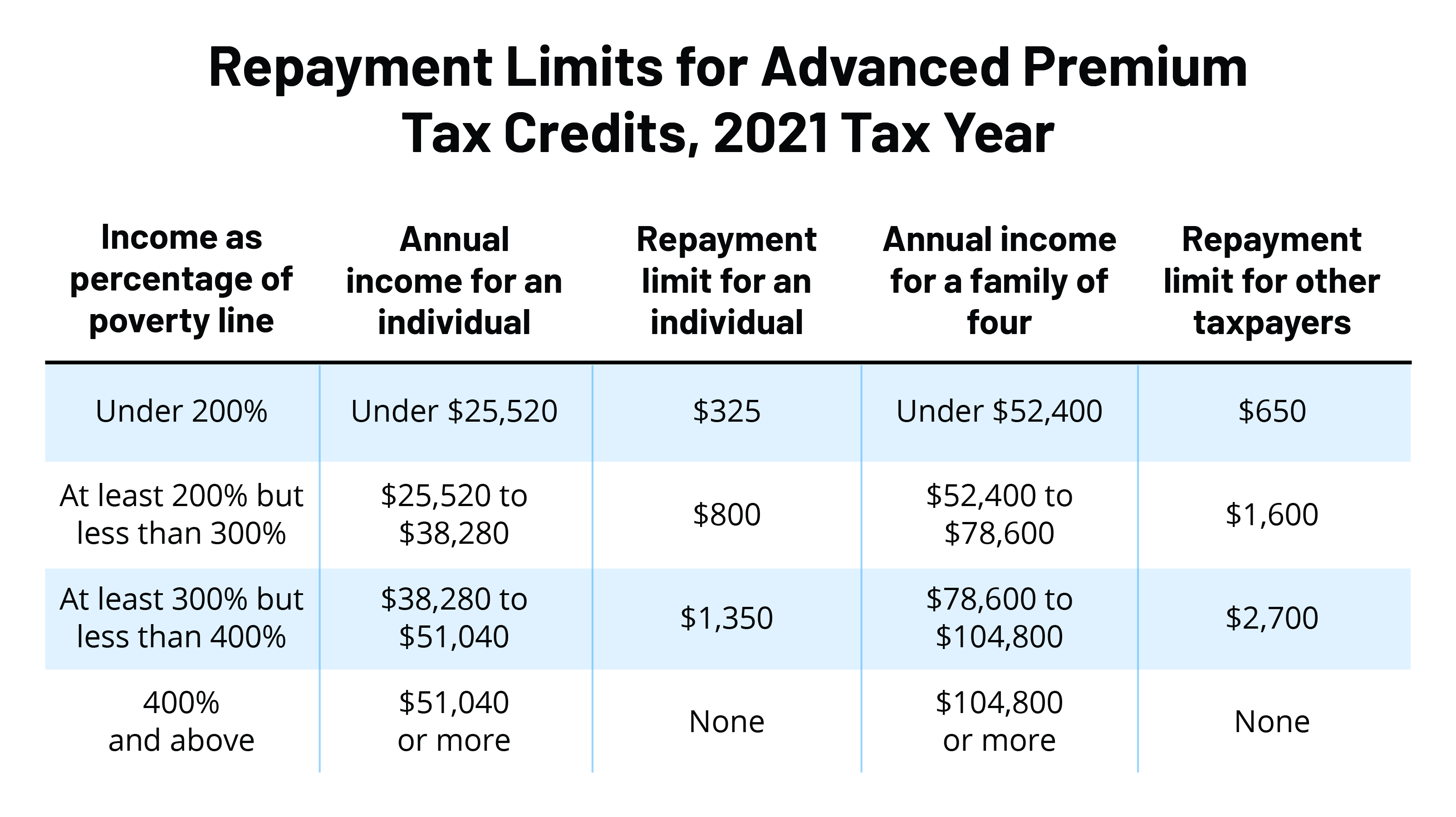

What S The Most I Would Have To Repay The Irs Kff

Claiming The Canada Workers Benefit Cwb 2022 Loans Canada

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Texas Solar Incentives Tax Credits Rebates Sunrun

Biden Has Put The Child Tax Credit On The Chopping Block As Democrats Mull Cost Cutting Measures The New Republic

Taxes 2022 More Americans Are Eligible For This Expanded Tax Credit

Taxes 2022 More Americans Are Eligible For This Expanded Tax Credit

New 3 000 Child Tax Credit Would Help 10 Million Kids In Poverty

Child Tax Credit Schedule 8812 H R Block

Stimulus Update What To Do If You Haven T Received Your Child Tax Credit Payment Yet

Child Tax Credit Payments 2022

Politifact Sen Manchin Wrong On Income Limits For Child Tax Credit Extension In Build Back Better

Here Are New Tax Law Changes For The 2022 Tax Season Forbes Advisor

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet

Tax Credits For Higher Education H R Block

Inflation Defined Why Costs Proceed To Rise And Who S To Blame Alishop123 High Quality Free Shipping Order Now In 2022 Blame Developed Nation Historical Context

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet